Jupiter Faucet

Jupiter Faucet

Understanding the dynamics of a crypto order book is crucial for anyone looking to navigate the cryptocurrency market effectively. In this list, we have compiled three articles that delve into different aspects of the crypto order book, providing valuable insights and strategies for traders and investors.

Unpacking the Crypto Order Book: A Comprehensive Guide

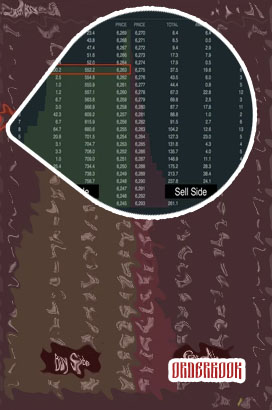

In the fast-paced world of cryptocurrency trading, understanding the order book is crucial for making informed decisions. The order book is a real-time display of buy and sell orders for a particular cryptocurrency, providing valuable insight into market sentiment and potential price movements. "Unpacking the Crypto Order Book: A Comprehensive Guide" offers a detailed exploration of this essential tool, breaking down its components and explaining how to interpret the data.

One key aspect covered in the guide is the concept of order types, including market orders, limit orders, and stop orders. By understanding the differences between these order types, traders can effectively strategize their trading approach and minimize risks. Additionally, the guide delves into the importance of order book depth and liquidity, highlighting how these factors can impact price volatility and order execution.

Furthermore, the guide provides practical tips for analyzing the order book, such as identifying support and resistance levels, spotting trends, and detecting market manipulation. By applying these techniques, traders can gain a competitive edge and make more informed trading decisions.

Overall, "Unpacking the Crypto Order Book: A Comprehensive Guide" serves as a valuable resource for both novice and experienced cryptocurrency traders. By mastering the concepts and strategies outlined in the guide, traders can enhance their trading skills and navigate the volatile crypto markets with confidence.

Strategies for Analyzing and Trading Based on the Crypto Order Book

Cryptocurrency trading can be a complex and volatile endeavor, but understanding how to analyze and trade based on the order book can give traders a significant advantage in the market. The order book is a real-time list of buy and sell orders for a particular cryptocurrency, providing valuable insights into market sentiment and potential price movements. By utilizing strategies that leverage this information, traders can make more informed decisions and increase their chances of success.

One key strategy for analyzing the order book is to look for large buy or sell walls. These walls represent a significant number of orders at a specific price point, which can act as a barrier to price movement. Traders can use this information to anticipate potential price reversals or breakouts.

Another important strategy is to pay attention to order book depth. This refers to the total volume of buy and sell orders at different price levels. Traders can analyze the depth of the order book to gauge the level of support or resistance at various price points, helping them identify potential entry and exit points for trades.

Additionally, traders can use order book data to identify trends and patterns in market behavior. By monitoring changes in order book dynamics over time, traders can gain valuable insights into market sentiment and make more informed trading decisions.

The Impact of Market Depth on Crypto Order Book Dynamics

The research <a href"/bombcrypto-12">Bombcrypto shed light on how the level of liquidity in a market can significantly impact the behavior of traders and the overall health of the market.